In this age of fast technological advances, companies are constantly adapting to evolving consumer demands. Disney, a brand recognized for engaging storytelling, is not immune to these changes. While it shifts its business model to integrate technological advances, enter new markets, and look into the possibilities of new business models, investors are left to wonder whether Disney shares are a good investment in the near future. This article will examine the position of Disney in the market and explore the potential of it as an investment opportunity.

A Snapshot of Disney’s Evolution

The company was founded in 1923. Disney is among the most enduring entertainment firms, spanning generations through its famous characters and storytelling skills. It started with animated films but has since expanded to encompass theme parks, streaming services, television networks, and much more. With such a broad range of business sectors, Disney’s success is mainly due to the ability of its employees to change within the constantly evolving entertainment market.

Disney’s Recent Financial Landscape

Disney and other companies were significant victims of the COVID-19 epidemic. The theme parks shut down, film productions were cut off, and consumer behavior changed drastically. However, the company swiftly adjusted by focusing on its streaming services, specifically Disney+, which amassed more than 160 million users when it was launched in 2019. The rapid growth is a testament to the company’s flexibility.

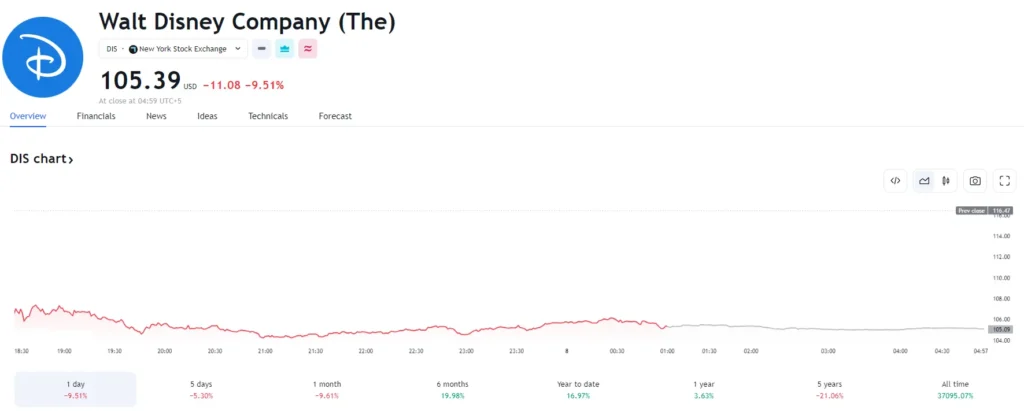

Current price in 2024

Major Business Segments

Understanding the potential of Disney requires an understanding of its principal business areas, including:

Media Networks

This includes TV networks such as ABC, ESPN, and National Geographic, producing substantial income from advertisements, subscription fees, and affiliate payments. However, traditional cable networks are facing the challenge of streaming platforms, causing Disney to rely heavily on its streaming services.

Parks, Experiences, and Products

Disney manages theme parks worldwide, including Disneyland, Walt Disney World, and many other international destinations. Beyond theme parks, the category comprises resort hotels as well as authorized consumer goods. Post-pandemic recovery has led to an increase in interest in theme park travel; however, this market is highly sensitive to economic changes worldwide.

Direct-to-Consumer and International

This is primarily comprised of Disney+, Hulu, and ESPN+, which cater to viewers worldwide with a wide variety of content. Disney’s response to changing media consumption patterns is to gain market share by offering exclusive content and bundles.

Studio Entertainment

The production arm of Disney’s movies remains a formidable force that has produced iconic franchises such as Marvel, Star Wars, and Pixar. Despite disruptions due to pandemics, Disney is slowly returning to production levels pre-pandemic.

The Future of Disney Stock

Investment Opportunities and Challenges

- Streaming Wars and Revenue Diversification Disney+ has achieved unprecedented success, but intense competition is coming from Netflix, Amazon Prime, and other providers. Diversifying content and managing production costs will be essential in sustaining growth. Additionally, shifting the focus to traditional media and streaming is a matter of intelligent advertisements and subscription models.

- Themed-Based Entertainment Recovery In the wake of a recovery in travel post-pandemic, Disney’s parks sector will continue to grow. However, rising inflation and possible economic recessions could affect the discretionary spending of travelers and entertainment. Disney must carefully manage pricing strategies and improve experiences to attract more guests.

- Content production and franchises Disney’s acquisition strategy has bolstered the portfolio of intellectual properties; however, maintaining engagement with the audience requires continual improvement. The rapid growth of artificial intelligence (AI), generative AI, and interactive media could provide new possibilities for storytelling and cross-platform integration.

- Global Market Expansion Disney intends to expand its global reach, focusing on Asia, Latin America, and Africa. Understanding its audience’s diverse preferences and the regulatory landscape is crucial to the success of this venture.

- Innovative and Technology Integrating cutting-edge Technology in the user experience, like augmented reality and virtual reality and personalized recommendations, will be essential. The emerging metaverse concept may bring new opportunities for the Disney brand’s products and interactions.

Market Analysts’ Predictions

Market analysts are divided on Disney shares. Bulls insist on the company’s unparalleled content collection, established worldwide brand, and the potential for growth in streaming. They believe that Disney is in an excellent position to take advantage of this digital age. The bears, however, are worried about the competition in streaming markets, declining subscriptions to cable, and macroeconomic headwinds that could affect growth.

Despite these issues, Disney remains a prominent figure in entertainment with diverse income streams. The company’s popularity, size, and readiness to embrace digital change give hope for the future.

Conclusion

Disney’s stock is bound to face problems due to changes in the market, competition, and economic turmoil. However, its long-standing ability to innovate and its strategic investments in Technology and content can make it an essential actor in the future of entertainment. Investors need to weigh the potential risks and rewards carefully and consider their investment goals and willingness to tolerate market volatility before deciding whether Disney is a good investment for the future.