It is believed that the GameStop (GME) scandal brought the world of finance to storm at the beginning of 2021 as retail investors regrouped to compete with short-sellers of institutional scale and caused the stock to rocket up. Fast forward to the present day, and GME is still a hot subject. Market analysts, investors, and investors are offering their opinions on whether GME is an investment that is long-term and wise or just a remnant of speculative mania. Let’s explore the reasons driving the appeal of GME, the current financial climate, and the dangers and rewards that come with investing in top stocks for the coming years.

A Quick Recap of the GME Story

The GameStop stock-price saga began when retail investors, a majority of whom were connected through social media platforms, such as Reddit’s WallStreetBets, launched a joint campaign to purchase options and shares of GME in the hopes of triggering an immediate short squeeze on hedge funds that had invested in the company. This led to GME going from a mere $20 per share to more than $400 in just a few weeks. While the price eventually fell, the soaring fluctuation led to an increased examination of retail and institutional investing practices and the shifting interactions between various investors.

Understanding GME’s Appeal

Retail Investor Movement

The GameStop incident demonstrated the potential for retail investors to influence markets by forming online communities. This has continued to influence stock price movements and investment decisions. Similar trends have emerged for stocks like AMC and Bed Bath & Beyond.

Nostalgia and Recognition

GameStop’s brand’s popularity and its nostalgic appeal to gamers further enhance its appeal. Many customers who grew up with physical games at GameStop have a deep emotional attachment to the company, inducing speculation buying.

Repositioning Efforts

Following the surge in stock prices, GameStop’s executive and management were undergoing a significant overhaul. This resulted in Ryan Cohen, the co-founder of Chewy and Chewy, assuming a leading post as Chairman. He took the first steps in transforming GameStop into a contemporary digital retailer that concentrates on e-commerce and takes advantage of trends like gaming, collectibles, and NFTs (Non-Fungible Tokens).

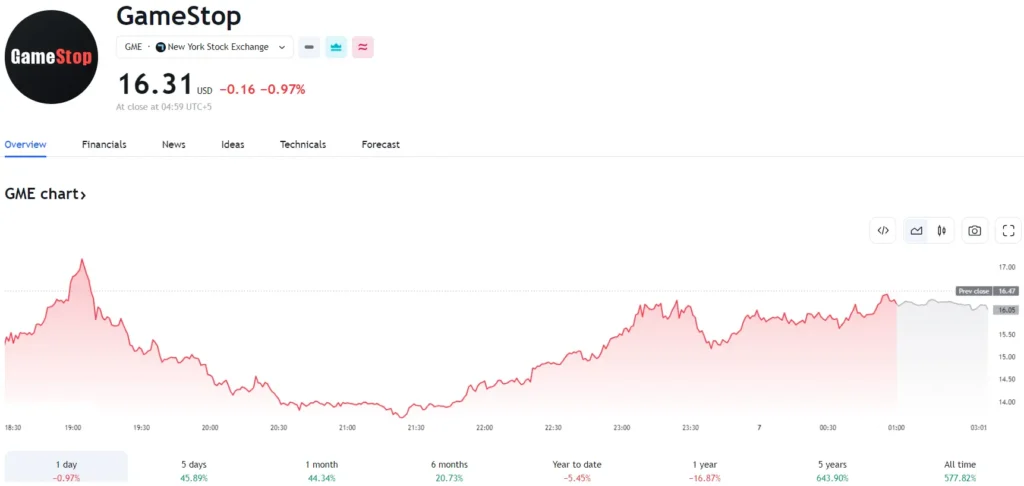

Current price in 2024

Evaluating GME’s Long-Term Potential

While speculation-driven trends have helped bring GameStop to prominence of discussion, considering the company’s real-time investment opportunities requires a thorough knowledge of its fundamental business and the outlook for the industry and the general market environment.

Financial Fundamentals

GameStop’s financial stability is a major concern because of its dependence on brick-and-mortar stores, which is being challenged by the distribution of digital games. Despite the rise of online sales, physical stores are struggling with declining profits and revenues. The business’s future viability is contingent on the company’s ability to pivot effectively and decrease the burden of debt.

Industry Trends

Gaming is booming, and the growth of mobile gaming, e-sports, and cloud gaming is revolutionizing the way that gamers engage. However, GameStop faces challenges due to the distribution of games online directly through publishers, which bypasses physical stores completely. The success of subscription-based models such as Xbox Game Pass also disrupts traditional retail. GameStop must reconsider its role within the new market.

Transformative Strategies

GameStop’s new strategy focuses on e-commerce growth, improving the efficiency of its supply chain, and investigating growth opportunities like NFTs. The company has brought in top executives from Amazon, Chewy, and other successful tech giants to guide this change. A successful transition to digital channels may aid GameStop in recovering and positioning itself more effectively, but the risk of implementation remains high.

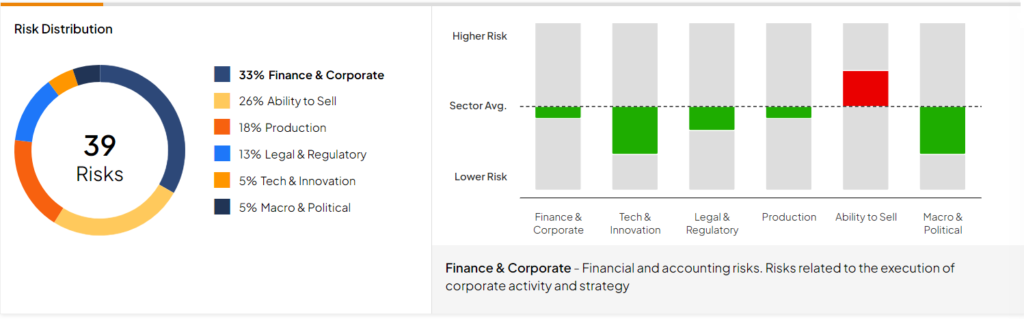

Risks of Investing in GME

Risk Overview 2024

Market Volatility

GameStop’s stock has been experiencing substantial volatility fueled by speculation, market trends, and the social web. This puts it at risk for cautious investors who want steady returns.

Regulatory Scrutiny

The unprecedented rise and subsequent fall in GME stocks at the beginning of 2021 prompted regulatory scrutiny. Market regulators are currently watching closely the effects of social media platforms on price movements, which could affect future trading patterns.

Execution Challenges

GameStop’s strategy for repositioning requires perfect execution to succeed in a rapidly changing digital environment. It is yet to be determined how the management team can reconcile innovation and efficiency with managing shareholders’ expectations.

Conclusion: GME in Your Portfolio

The decision to invest in GameStop as one of the most promising future stocks is a risk heavily based on its ability to adapt and gain market value. Although it is a reputable brand with a loyal customer base and a bold transformation plan, investors must be prudent and evaluate their risk tolerance prior to investing.

The best stocks to invest in for the future usually have steady growth, solid financials, and new strategies that match the latest market trends. Diversifying your portfolio by combining opportunities for growth like technology with value stocks, defensive industries, and alternative investments could aid in balancing risk and reward. If or when GME is a success story in the future, technology will change how investors think about the market and the impact of social media on investing.