Introduction

In the ever-changing world of the automotive industry, Ford Motor Company remains a major player due to its record of innovation and adaption. In the near future, Ford’s shares will be considered using a fintech lens, which provides insight into the company’s potential growth and challenges. This article thoroughly analyzes Ford’s position and potential future growth prospects in a rapidly evolving electronic and electric vehicle-focused market.

Ford’s Recent Performance

The recent performance of Ford’s financial record is the company’s transition. Despite global supply chain disruptions as well as shortages in semiconductors, Ford has managed to remain competitive. Launching models such as those of the Mustang Mach-E and the F-150 Lightning is a clear sign of Ford’s commitment to electrification, a major aspect of its future growth strategy. They haven’t just improved sales and established Ford as a market leader within the electrified vehicle (EV) market, which is crucial to its future success in the automotive sector.

Strategic Shifts and Technological Innovations

Ford’s shift to digital services and electrification marks a change in its business model. The company’s investment in the electric vehicle, its autonomous technology, and the expansion of mobility services signal an active adaptation to the ever-changing automotive landscape. Ford’s partnership with technology companies to increase vehicle connectivity and the ability to drive autonomously ensures its growth path for the future.

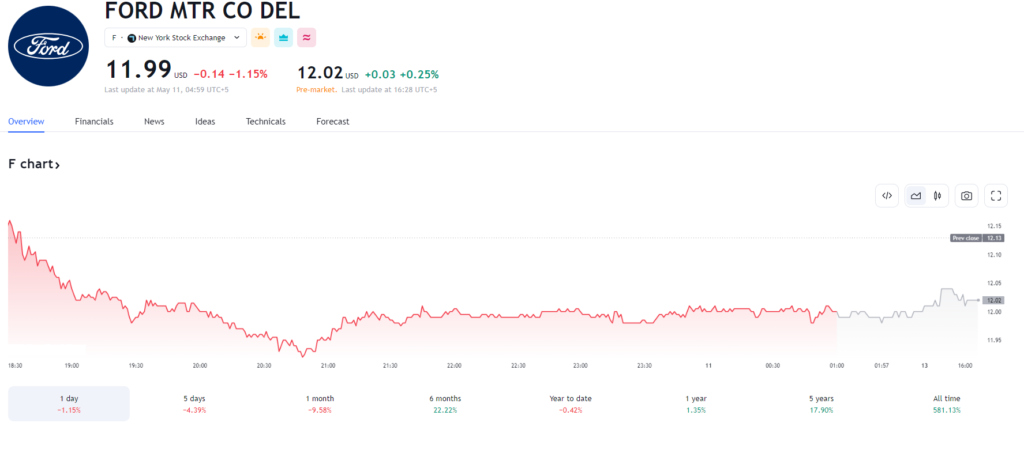

Current price in 2024

The Financial Condition and Market Position

In assessing Ford’s financial health, Ford has taken drastic steps to improve the balance sheet of its business, decreasing the amount of debt it has and improving its liquidity. These financial adjustments will allow Ford to invest in the latest technologies and expand its product range. The market sentiment toward Ford shares is becoming more positive, indicating confidence in its strategic plans and its capacity to profit from its position in the EV market.

The Competitive Landscape

The auto industry is extremely competitive, with traditional automakers as well as new players such as Tesla and Rivian altering the market dynamics. Ford’s ability to stay competitive depends on its constant development and successful penetration through its EVs. Ford’s vast dealer network and strong brand loyalty are key advantages in battling established and emerging players.

Challenges and risks

Despite its optimistic forecast, Ford faces several challenges. The shift to electric vehicles will require massive capital investments in research and development and manufacturing capabilities. In addition, global economic instability, fluctuating raw material prices, and possible trade disputes could affect Ford’s operating costs and profit margins. Changes in regulations around emissions and vehicle safety standards can also create constant compliance costs and design issues.

Environmental Social, Governance (ESG) The factors

Ford’s commitment to sustainability can be seen in its ESG initiatives, which are more significant for investors. Ford’s efforts to reduce its carbon footprint, increase the efficiency of manufacturing using energy, and encourage work practices boost its reputation and attract conscious investors.

Future Growth Opportunities

Ford’s future growth opportunities include expanding its EV range, enhancing digital services, and experimenting with new business models for mobility solutions. The predicted rise in demand for electric vehicles is an enormous growth opportunity for Ford as long as it continues to develop and keep pricing competitive. In addition, Ford’s efforts in autonomous vehicles and data-driven services technologies could create new markets and revenue streams.

Potential for Investment

Ford represents a mix of stability and future-oriented growth prospects for investors looking to invest. Ford’s continuous investments in technology, the development of new energy vehicles, and its market-leading position and brand equity make it a compelling choice for investors looking to take advantage of the automobile sector’s reshaping.

Conclusion

Ford’s share is poised to grow thanks to its strategic shifts toward electric vehicles and digitalization. Even though there are some challenges Ford’s proactive strategy and strong financial foundation allow it to deal with future uncertainty. According to FintechZoom, Ford is an investment to watch, as it can change and grow in the future automotive market. Both industry and investor watchers must focus on Ford’s growth on the EV sector and its adaption to new technological trends.