Introduction

Roku Inc. (ROKU) has grown into a significant player in the market for streaming devices and offers a variety of products that allow users to stream Content from a variety of websites directly to their TVs. In 2024, Roku’s performance in the stock market is being closely monitored by analysts and investors. This article examines the present situation of Roku’s stock and its past performance, as well as future perspectives, using data and information from FintechZoom.

Roku’s Market Position

Roku has proven itself to be the leader in the field of streaming devices. Its user-friendly interface, extensive content library, and affordable prices have made it a top choice with customers. The firm’s solid market position is evident by its stock performance, which has experienced a significant increase over the last few years.

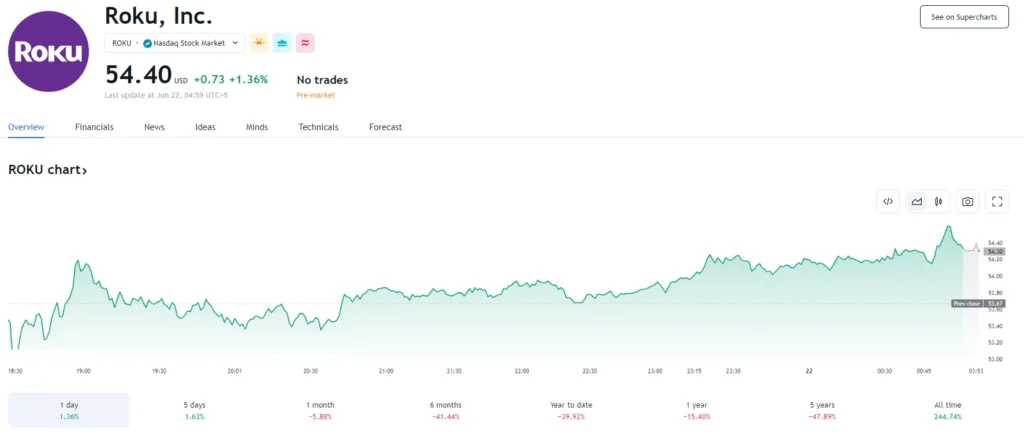

Current price in 2024

Historical Performance

Roku’s stock has experienced significant fluctuations since its IPO in 2017. At first, at $14 per share, the stock soared to more than $400 per share by mid-2021 due to the increase in streaming services during the COVID-19 pandemic. However, like many other tech companies, Roku faced a correction in 2022 when its price fell to below $200.

Recent Trends

In June 2024, Roku’s shares were fluctuating between $250 and $300. The increase is due to a variety of reasons:

- Expansion into new Markets: Roku has increased its international presence and has tapped into the growing markets in Europe as well as Asia.

- Collaborations and Partnerships: Partnerships and collaborations with the primary providers of Content, as well as streaming services, have bolstered Roku’s offerings in the area of Content.

- New Products Roku continues to create new products like Roku Streambar and Roku TV, which consumers and the media have praised.

Financial Performance

Roku’s financial results have shown its resilience in the face of market volatility. In the first quarter of 2024, Roku recorded a 25% year-over-year revenue increase, fueled by increased device sales and advertising revenue. The company’s number of active accounts grew by 10% to reach 75 million, indicating high user engagement.

Challenges and risks

Despite its solid market position, Roku faces several challenges:

- Competitiveness: The market for streaming devices is highly competitive, with the most prominent players being Amazon Fire TV, Apple TV, and Google Chromecast.

- Costs of Content Licensing Costs for licensing content are rising and could affect Roku’s profit.

- Risks for Regulatory Compliance: Changes in regulatory policies, specifically in relation to the security and privacy of data, may pose risks to Roku’s business model.

Future Outlook

The outlook for the future for Roku is positive, and there are various growth factors:

- Advertising Revenue The advertising service offered by Roku, Roku Ad Insights, is expected to lead to significant growth in revenue as more advertisers make the switch towards streaming platforms.

- Original Content investing in quality content may attract more users and improve participation on the Roku platform.

- Technological Developments: Continued advancements in streaming technology and the integration of smart home devices can improve Roku’s offerings.

Conclusion

Roku’s stock price performance reflects its solid market position and innovative approach to streaming devices. While there are challenges ahead, the company’s strategic efforts and growth potential make it a good choice to take on the challenges of tomorrow. Analysts and investors will continue to watch Roku’s performance carefully, keeping an eye on market developments and technological advancements.

For up-to-date information and thorough economic analysis, FintechZoom is a great source for investors interested in Roku’s shares. As the streaming landscape evolves, Roku’s ability to adapt and innovate will be essential to maintaining its position as a leader.