The world of financial technology is constantly evolving. One of the most prominent players in recent times has been Meta Platforms, Inc., formerly Facebook, Inc. This article focuses on the current performance, trends, and future of Meta shares, as reported by FintechZoom, an industry-leading technology news site, and analysis of the financial sector.

An overview of Meta Platforms, Inc.

Meta Platforms, Inc. was rebranded as Facebook in October 2021. The company has expanded its reach beyond social media. The company is now focused on creating the Metaverse, a virtual space. The ambitious plan includes augmented reality (AR), virtual reality (VR), and other advanced technologies that make Meta a key technological player.

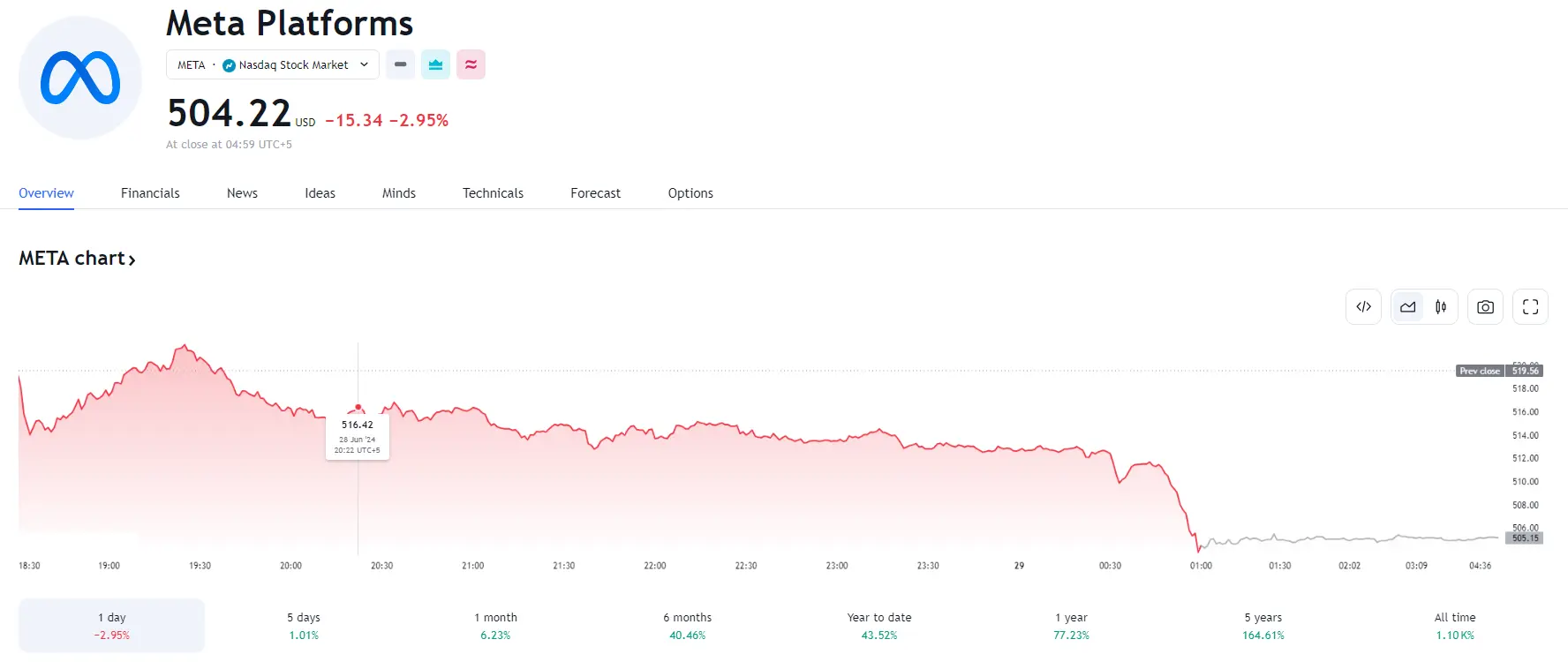

Current price in 2024

Historical performance of Meta Stock

Meta stock has experienced an exciting but volatile experience since its initial open market (IPO) in the year 2012. Here are some essential historic milestones:

- Initial public offering (2012): Meta (then Facebook) went public at $38 per share. Although initially skeptical and with rough beginnings, the stock eventually stabilized and started its upward trend.

- Data Privacy Scams (2018): The Cambridge Analytica scandal and subsequent privacy concerns involving data caused massive drops in value. But Meta’s resilience and strategic pivots have helped it rebound.

- Change of branding into Meta (2021): The announcement of the rebranding, as well as the emphasis on the Metaverse, caused some mixed reactions from investors. While some were enthusiastic at the prospect of a new direction for their business, some were hesitant regarding the enormous investment required.

Current Trends, Performance, and Results

According to FintechZoom, recent developments in Meta stock indicate a booming performance that headwinds could impact

- Increase in Revenue: Meta has shown constant revenue growth, which is mainly driven by advertising revenues. The company’s goal is to expand its AR capabilities and virtual reality capabilities, which will create new streams of revenue.

- Engaging Users: In spite of the controversy, Meta’s platform (Facebook, Instagram, WhatsApp) remains flush with the highest levels of user engagement. The integration of e-commerce capabilities has increased user interaction and the potential for monetization.

- Investments in the Metaverse Major expenditures in AR and VR technology are considered to be both a potential opportunity and risk. The long-term rewards are widely anticipated; however, the financial burden in the short term is significant.

Meta Analyse of Stock by FintechZoom

FintechZoom provides an in-depth study of Meta stock and highlights several crucial factors:

- Financial Reports The quarterly reports of Meta’s earnings always show a strong performance and significant increases in profits and revenue. Analysts at FintechZoom often emphasize its ability to make money from its users effectively.

- Markt Position Meta is a substantial player within the social media landscape. Diversification into the Metaverse, as well as other technological advancements, is considered a strategic move to keep its position.

- The competitive environment: Meta faces competition from other tech giants such as Google, Apple, and emerging Metaverse players. FintechZoom emphasizes how important Meta’s creativity and flexibility are to maintain its edge in the market.

Future Perspectives

FintechZoom’s projections of Meta share are raised with cautious optimism. Here are the main factors that will affect the outlook for the future:

- Metaverse The development process: The success of the Metaverse initiative will play a vital role in the determination of the Meta’s stock’s performance in the future. The positive developments in this area can lead to significant long-term gains.

- Regulations Challenge In-depth scrutiny and the possibility of legislative actions relating to the privacy of data and monopolistic practices could affect Meta’s operations as well as its stock value.

- Technology-driven innovation: Continuous innovation in AR, VR, AR, and AI is essential for Meta to remain competitive in the technological world. FintechZoom stresses how important it is to make strategic investments as well as partnerships in this area.

Conclusion

Meta Platforms, Inc., is in a pivotal position and represents a huge opportunity driven by its bold Metaverse vision. FintechZoom’s thorough analysis provides insight into the current developments, issues, and future outlook of Meta shares. Investors and other stakeholders are monitoring how Meta moves through this transformational stage, with an attentive focus on its financial performance and technological developments.

As with all potential investors, they must be thorough in their research and consider different perspectives before making investments. Meta’s success is testimony to the ever-changing and constantly evolving technology industry, which promises to be a booming one in the coming years.