Certain stocks in investing are indicators of the more significant economic trend and sentiment of investors. One such stock is SPDR S&P 500 ETF Trust, also known as SPY. As we enter the 21st century, the investing world is changing and influenced by technological advances and shifting economic trends. This article examines why SPY, one of the most influential U.S. companies, is considered an excellent investment for the future, specifically within the rapidly growing fintech industry.

Understanding SPY Stock

Before looking at its future outlook and assessing its prospects, knowing the nature of SPY stock is essential. SPY is the SPDR S&P 500 ETF Trust, an exchange-traded fund (ETF) designed to produce investment results that, prior to expenses, are generally in line with the yield and price performance reflected in the S&P 500 Index. When investing in SPY, the investors purchase part of the 500 most significant and most potent corporations across the U.S., spanning various sectors. This broadens the portfolio and ensures that SPY is an essential component of the portfolios of investors looking to gain exposure to the U.S. capital market.

The Role of Technology and Fintech

Financial technology, also known as fintech, is at the forefront of changing the world of financial services. From mobile banking to automated investment advisors to blockchain and cryptocurrency technology, fintech innovations are changing the way that money is managed. SPY shares, as a result of its broad exposure, encompass a wide range of companies significantly influenced or driven by these technological advances.

Companies such as Apple, Amazon, and Alphabet are all part of SPY ETF, adding financial services to their offerings, thereby mixing traditional financial functions with technology. Apple’s move into mobile payments via Apple Pay, Amazon’s extension into lending to small businesses, and Alphabet’s involvement in blockchain technology are examples of how tech giants are leading the current fintech revolution.

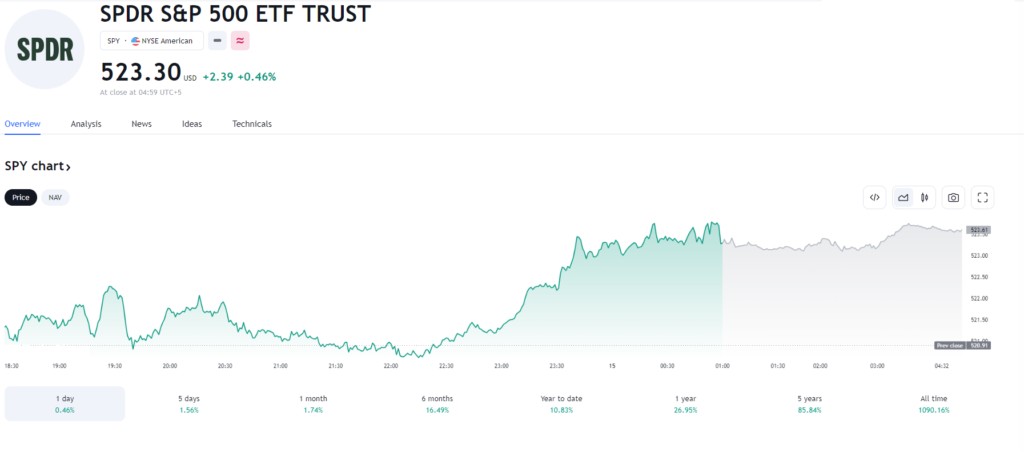

Current price in 2024

Economic Indicators and Market Sentiment

SPY is typically considered an investment in the U.S. economy. Its performance is linked to economic indicators, such as employment rates, GDP growth, and consumer confidence. In the meantime, as the U.S. economy continues to recover and adjust in the post-pandemic world, the S. Theortfolio is diverse and positions it to benefit from growth across all sectors. Additionally, SPY offers liquidity and flexibility, allowing investors to react quickly to shifts in economic and market circumstances.

The Advantages of ETFs in Modern Investing

ETFs such as SPY provide various benefits that attract today’s investors, particularly in a world dominated by online trading platforms and a trend toward more efficient and affordable investments. For one, ETFs offer a simple option to have diversified exposure to a broad range of assets in one transaction. Additionally, they are famous for having low expense ratios compared to mutual funds. Additionally, the transparency of ETFs, in which holdings are made public every day, allows investors to see the direction their money is heading in line with the growing demands for transparency in the modern age.

SPY and the Future of Investing

In the future, SPY will remain a key player in portfolios of investments, not just due to its past performance but also its compatibility with emerging economic developments. Since environmental, social, and environmental (ESG) factors have become more influential in investing decisions, SPY’s member businesses are increasingly adopting sustainable methods singly adoptiermore since the global economy has grown. Tech-focused holdings of SPY will boost its expansion, which makes it an appealing alternative for investors confident about fintech and tech.

Conclusion: A Strategic Choice for Future-Focused Investors

If you seek a share that reflects the U.S. economy and is likely to expand with the revolution in fintech, SPY represents a strategic option. It provides stability, diversification, and exposure to cutting-edge sectors that will determine the coming decades of economic growth. If you’re a veteran investor or are just beginning your journey, looking into SPY as part of your portfolio is an excellent choice for investors looking to take advantage of future developments in the global economy.

In the end, looking ahead to an era of technological advancements and digital finance services, SPY is a standout not just because it reflects our current economic climate but also as a symbol of tomorrow’s opportunities. Investing with SPY will help you invest in the next generation of financial services, in which technology and traditional methods combine to provide new opportunities for investors around the world.