Customer Relations Management (CRM) Software is essential for companies looking to efficiently control their interactions with current and potential customers. Salesforce.com, Inc. (CRM), one of the most prominent names in the CRM market, has always caught the interest of analysts and investors. This article provides a comprehensive analysis of CRM’s stock using data and information from FintechZoom, an acclaimed financial news site.

Overview of Salesforce (CRM)

Salesforce.com, Inc., is an American cloud-based software company headquartered in San Francisco, California. Founded in 1999 by Marc Benioff, Parker Harris, Dave Moellenhoff, and Frank Dominguez, Salesforce has transformed the field of CRM with its innovative solutions.

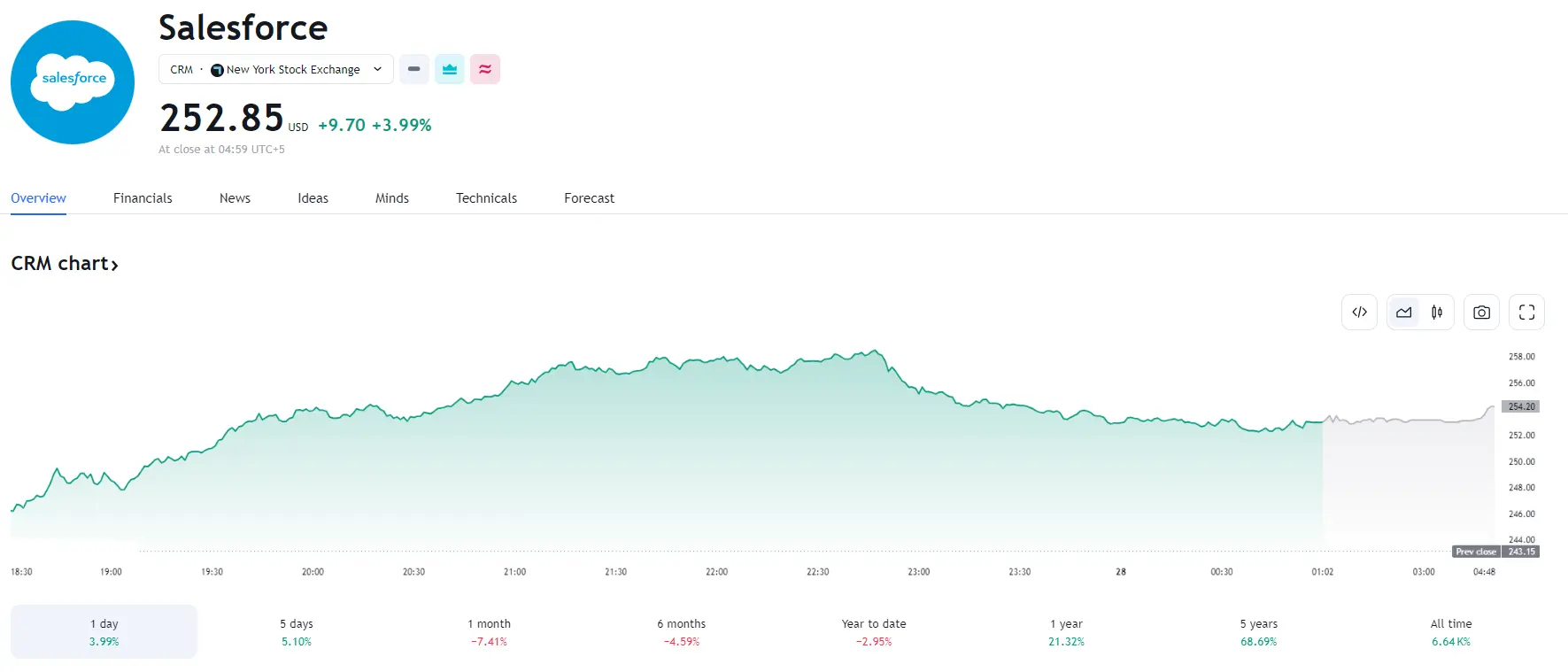

Current price in 2024

Financial Performance and Stock Analysis

Revenue Growth

Salesforce has seen incredible growth in its revenue over the last decade. The annual revenue of the company in the fiscal year 2023 totaled $26.49 billion, a jump of $21.25 billion during FY 2022. This upward trend illustrates Salesforce’s ability to grow its market share and continuously improve the quality of its products.

Earnings Per Share (EPS)

Salesforce’s EPS has also demonstrated positive signs. In the most recently reported quarter, Salesforce announced adjusted earnings per share of $1.48, which beat analysts’ estimates of $1.36. The consistent performance has increased investors’ confidence in CRM stocks.

Key Financial Metrics

- Market Capacity In June 2024, Salesforce’s market capitalization was around $240 billion, which made Salesforce one of the biggest software companies in the world.

- Cost-to-earnings (P/E) Ratio CRM’s P/E ratio is 50 or less, which suggests the high expectations of investors of future growth.

- Dividend Yield Salesforce is currently not paying dividends, preferring instead to invest earnings into growth projects.

Recent Developments and News

Strategic Acquisitions

Salesforce’s strategy involves significant acquisitions to increase its product offerings and expand its market reach. Some notable acquisitions include Tableau (for data visualization) and Slack (for collaboration and communication). These acquisitions have been seamlessly integrated into Salesforce’s ecosystem, resulting in even more expansion.

Product Innovations

Salesforce continues to innovate through recent announcements, including the release of Salesforce Genie, an in-real-time data platform, and improvements to the AI-driven features within Salesforce Einstein. These new features put Salesforce at the top of the CRM market.

Analyst Ratings and Future Outlook

Analyst Ratings

According to FintechZoom, the majority of analysts recommend a ‘Buy’ rating for CRM stocks. Of 35 analysts, 28 suggest a ‘Buy’ rating, and 7 recommend a Hold.’ There are no analysts currently evaluating CRM as a Sell.’

Future Outlook

Salesforce’s outlook for the future is positive. The company hopes to earn $50 billion in revenues in FY 2026, thanks to its expansion into new markets and constant product innovations. Analysts anticipate a steady rise in the price of its stock and target a cost of $300 by 2024’s end.

Investment Considerations

Strengths

- Market leadership: Salesforce is the undisputed leader in the CRM market, with a substantial market share.

- Innovation Continuous innovation in product design ensures that Salesforce keeps ahead of its competitors.

- Financial Health: A strong growth in revenue and favorable cash flow positions Salesforce well-positioned for future investments.

Risks

- Value The high ratio of P/E indicates that the company is priced to perfection. Any missteps could trigger significant price adjustments.

- Competition The growing competition from companies such as Microsoft Dynamics and HubSpot could affect Salesforce’s dominance in the market.

- Economic downturns Macroeconomic influences and possible recessions may affect Salesforce’s growth.

Conclusion

Salesforce (CRM) remains an attractive investment option due to its market leadership, innovative products, and solid financial performance. Although there are risks with high valuations and increased competition, CRM’s strategic acquisitions and constant innovation offer the foundation for growth in the future. Investors must consider these aspects when assessing CRM stock, which is one of the stocks in their portfolio.

For the most recent updates and in-depth analyses, FintechZoom remains a reliable source for investors seeking to keep up-to-date with Salesforce and other essential participants in the financial markets.