Overview:

Amazon is one of the most renowned technology firms, and it is well-known for its dominant position in cloud computing, e-commerce, and streaming services. With its market capitalization frequently fluctuating between hundreds of trillions, Amazon can be seen as an essential investment in several portfolios. However, as with all prominent stocks, they are subject to endless discussions about their future performance. FintechZoom is an important fintech platform that offers important information about Amazon market trends, stock sentiment, and the general e-commerce environment. Let’s examine Amazon’s current position and prospects in the ever-changing world of finance.

Amazon’s current market position:

Amazon is an undisputed colossal company. It is the largest player in online retail sales in the United States and globally. The company’s Amazon Web Services (AWS) division continues to be a leader in cloud computing. In addition, Amazon’s efforts in streaming, logistics, and emerging markets such as healthcare are part of a diverse revenue stream. FintechZoom’s analysis usually reveals that these various operations give Amazon an advantage in the market.

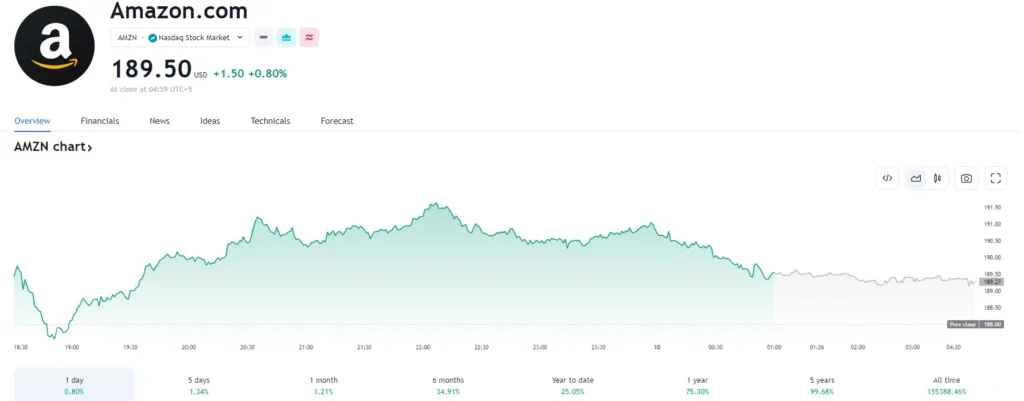

Current Price in 2024

Key Revenue Streams

- Online shopping: With a vast number of third-party sellers, Amazon has a solid customer base that spans a range of areas. The latest innovations, such as Prime Membership, 1-day delivery, and a wide range of online storefronts, have consolidated its position as the dominant company.

- Cloud Computing (AWS): AWS has evolved into a thriving service, offering businesses crucial cloud infrastructure and tools for scaling and data management.

- Subscriber Services Services such as Prime Video, Audible, and Amazon Music amplify the customer experience while also generating the opportunity to earn recurring income.

- With its growing advertising technology, Amazon monetizes its extensive user database to provide targeted ads to its vast users.

Problems and risks:

Despite its size and market share, Amazon faces challenges that could impact its stock’s performance. This includes:

- Regulative Examining: There is growing antitrust oversight and measures to regulate, particularly within the European Union and the U.S. This could affect Amazon’s business activities.

- Supply Chain Problems Global supply chain disruptions have affected Amazon’s inventory and logistics, which could impact its profitability.

- The rising competition Other tech giants and emerging companies are focusing on niches such as streaming, cloud computing, and online advertisements, which is accelerating the competition.

FintechZoom’s Perspectives about Amazon The Stock

FintechZoom offers comprehensive information on how market analysts view Amazon’s stock. This is particularly evident via interviews, market data, and investing strategies. They emphasize that the positive sentiment towards Amazon is still strong because of its broad business model and constant innovation.

- Innovation Insight: FintechZoom emphasizes Amazon’s constant innovation culture, which includes investment in AI, automation, logistics, and systems. It believes this will give Amazon an advantage in keeping operational efficiency.

- Acquisition Strategies: FintechZoom analyzes Amazon’s acquisition strategy and explains that acquiring companies such as Whole Foods, Ring, and MGM consolidate its multi-sector strategy.

- Finance Health: With solid revenue growth and positive liquidity from AWS, FintechZoom maintains that Amazon remains strong financially and can invest in new business areas.

Amazon Stock: Is it the best or not shortly?

Bullish scenario analysts who believe in Amazon are pointing to its expanding global footprint, massive information infrastructure, and customer base. AWS alone is likely a significant growth engine since the cloud market is not well-served. In addition, Amazon’s investments in new technologies, like AI voice-enabled assistants or autonomous delivery platforms, could make it a leader in the upcoming e-commerce market.

Bearish scenario On the other side, bearish analysts warn of the dangers of relying too heavily on AWS to grow. They say that tighter regulations could hinder Amazon’s plans, particularly if the company has to sell off parts of its operations. Additionally, rising the effects of inflation, supply chain restrictions, and growing competition could affect its margins and restrict its expansion.

Conclusion:

Amazon’s future prospects depend on how efficiently it can adapt to a constantly changing market. FintechZoom’s analysis suggests that even as the challenges loom, Amazon’s track record of innovation and diverse revenue streams provide a measure of flexibility. Investors must be aware of the regulatory environment, competition, and economic developments around the world to make educated decisions about Amazon’s shares.

In the end, although the market is volatile, FintechZoom’s research and data are valuable sources for better understanding the changes in Amazon stock. The bottom line is that Amazon remains an investment worth considering for people who believe in its ability to create and meet the future’s challenges.